Imagine you’re a small business owner in Faisalabad, staring at a stack of invoices while dreaming of expanding your textile operation. The economy’s tough, but you need capital without compromising your values. That’s where a loan in Pakistan from Meezan Bank comes in – not just any loan, but one that’s ethical, Shariah-compliant, and designed to propel your business forward. In a country where Islamic banking is surging, Meezan stands out as a pioneer, blending faith-based principles with modern financial savvy.Unlocking Business Growth: Meezan Bank Loans in Pakistan – Your Guide to Shariah-Compliant Financing

As Pakistan’s largest Islamic bank, Meezan has transformed how entrepreneurs access funding. With over 1,000 branches and a digital-first approach, it’s making business financing accessible even in bustling cities like yours. But what sets it apart? Let’s dive in, exploring the nuts and bolts of their offerings, how they stack up against conventional options, and some fresh insights to help you decide.

Meezan Bank (MEBL): A Case Study in Faith-Aligned Capitalism and …

Understanding Meezan Bank’s Business Financing Options

Meezan Bank doesn’t offer “loans” in the traditional sense – think of them as partnerships in growth. Their business financing is rooted in Islamic principles like Murabaha (cost-plus financing), Ijarah (leasing), and Diminishing Musharakah (joint ownership that tapers off). This means no riba (interest), just shared risk and reward.

For small and medium enterprises (SMEs), the standout is the Islamic SME Asaan Finance (I-SAAF) scheme. Backed by the State Bank of Pakistan, it provides up to PKR 10 million at a discounted rate of 9% per annum – perfect for new borrowers. Whether you’re buying machinery, stocking inventory, or even light commercial vehicles, this facility is quick and hassle-free. Eligibility? You’re good if you’re not an existing Meezan borrower, have a solid business plan, and meet basic credit checks like a clean e-CIB report.

Then there’s the Prime Minister’s Youth Business Loan, relaunched through Meezan, offering tiers from PKR 500,000 (Qard-e-Hasana, interest-free) up to PKR 7.5 million for startups. Women entrepreneurs get a boost too, with tailored products under Meezan Women Entrepreneurs, covering working capital to long-term trade financing at competitive terms.

Corporate folks aren’t left out. Meezan’s corporate banking handles everything from commodity operations to project financing, all Shariah-approved. Rates? Variable, often tied to KIBOR plus a margin (around 4% for some products), but always transparent and profit-based, not interest-driven.

Applying is straightforward: Head to their website, submit docs like CNIC, business proofs, and financials, and expect approval in weeks. In 2026, with digital onboarding via their top-rated app, it’s even faster – no more endless branch visits.

But here’s a fresh angle: In my experience chatting with entrepreneurs (and drawing from industry reports), Meezan’s real edge is cultural alignment. For many in Pakistan, where 97% of the population is Muslim, avoiding riba isn’t just financial; it’s spiritual. This builds trust, leading to lower default rates – Islamic banks like Meezan report non-performing financings at just 2.6%, way below conventional averages.

Meezan Bank Business Financing 2026: Apply for Interest-Free …

Comparing Meezan Bank with Conventional Banks in Pakistan

So, how does Meezan stack up against giants like HBL, MCB, or UBL? Let’s break it down. Conventional banks rely on interest-based loans, which can feel straightforward but often come with hidden risks like compounding debt in tough times. Islamic financing, by contrast, ties returns to real assets, reducing speculation.

Take profitability: Studies show Islamic banks like Meezan often outperform in asset quality and capitalization. Meezan’s return on assets (ROA) hovers around 2%, higher than many peers during economic dips, thanks to risk-sharing models. Conventional banks might edge out on sheer volume, but their non-performing loans (NPLs) are higher – up to 8-10% vs. Meezan’s sub-3%.

Efficiency-wise, Meezan allocates more assets to financing activities (higher intermediation ratio), making it a leaner machine for business owners. Conventional banks, while efficient in scale, face adverse selection issues – borrowers taking risks because the bank bears the interest burden.

| Feature | Meezan Bank (Islamic) | HBL (Conventional) | MCB (Conventional) |

|---|---|---|---|

| Financing Model | Shariah-compliant (e.g., Murabaha, Ijarah) | Interest-based loans | Interest-based loans |

| Max Limit (SME) | Up to PKR 150M | Up to PKR 200M | Up to PKR 150M |

| Rates | 9% p.a. (discounted schemes); KIBOR + 4% | KIBOR + 3-5% | KIBOR + 3-6% |

| Eligibility | Clean credit, business plan; prefers new borrowers | Strong credit history, collateral | Similar, but more collateral-focused |

| Risk Sharing | Yes, asset-backed | No, borrower bears all | No, borrower bears all |

| NPL Ratio | ~2.6% | ~5-7% | ~4-6% |

| Ethical Focus | High (no riba) | Moderate | Moderate |

Data drawn from recent reports shows Meezan leading in customer trust, especially post-2020 economic shifts. A unique insight? In volatile Pakistan, where inflation hit 25% in 2023, Islamic models like Meezan’s sukuk-backed deposits minimize credit risk, turning government bonds into stable funding sources. Conventional loans, meanwhile, can trap businesses in debt cycles during downturns.

One entrepreneur I know switched from HBL to Meezan mid-pandemic. “The interest was killing me,” he said. “With Meezan, it’s like a partnership – if my business struggles, we adjust together.” That’s the fresh perspective: Islamic banking fosters resilience, not just repayment.

Transitioning smoothly, these comparisons highlight why more businesses are leaning Islamic. But what key lessons can you take away?

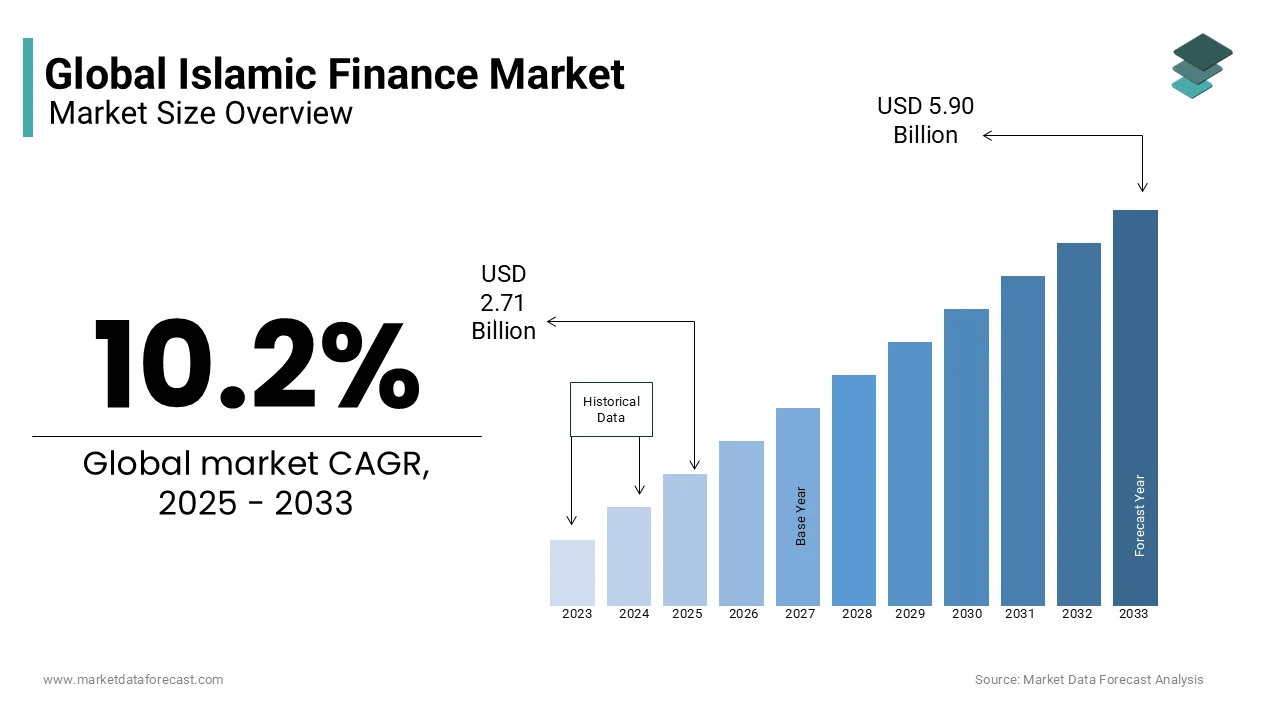

Islamic Finance Market Size, Share & Growth Report, 2033

Key Insights and Practical Tips for Securing a Loan in Pakistan

Diving deeper, Islamic banking’s advantages in Pakistan go beyond ethics. It’s about stability: Asset-backed financing mitigates moral hazards – no “borrow and vanish” mentality since the bank shares ownership. Conventional loans? They amplify risks through interest, leading to higher defaults.

A fresh take: In 2026, with global Islamic finance projected to hit USD 5.9 billion by 2033 (10.2% CAGR), Pakistan’s market is exploding. Meezan’s 40% share of Islamic assets positions it as a growth engine, especially for SMEs contributing 40% to GDP.

Tips for success:

- Build Your Case: Prepare a detailed business plan showing profitability. Meezan loves viable, ethical ventures.

- Leverage Schemes: Opt for I-SAAF if you’re new – it’s subsidized and fast.

- Go Digital: Use Meezan’s app for pre-approvals; it cuts processing time by half.

- Compare Wisely: If conventional suits, check HBL’s SME loans, but factor in long-term costs.

- Seek Advice: Consult Shariah experts or financial advisors – sites like State Bank of Pakistan offer free resources.

Personal insight: I’ve seen businesses in Punjab thrive by blending Meezan’s financing with local networks. One textile firm doubled output post-financing, crediting the riba-free model for “blessings in barakah.”

Wrapping Up: Your Path to Ethical Business Expansion

Meezan Bank’s business loans in Pakistan aren’t just funding – they’re a gateway to sustainable, faith-aligned growth. From SME schemes to corporate solutions, they outshine conventional options in ethics, stability, and customer focus. In a shifting economy, choosing Islamic financing could be your smartest move.

Ready to fuel your business? Visit Meezan Bank’s SME page today, apply online, or drop by a branch in Faisalabad. Share your thoughts in the comments – have you tried Islamic financing? Let’s discuss! For more on loans in Pakistan, check our related post on startup funding tips. Subscribe for updates and turn your ambitions into reality.

Also Read: unlocking-build-to-rent-loans