Why Saving Feels Different in 2026

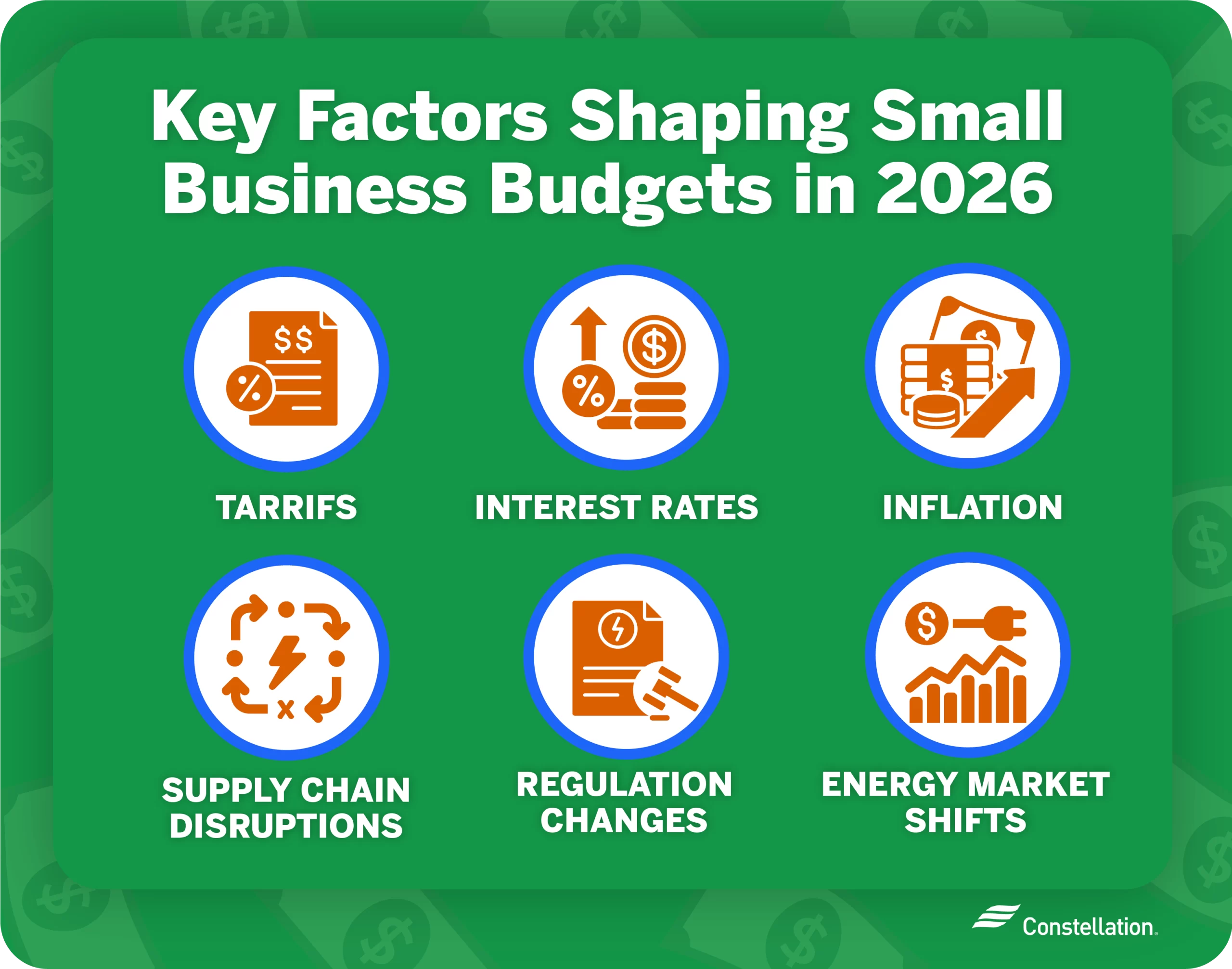

Picture this: It’s early 2026, inflation has cooled from 4.2% in 2025 to a projected 3.7% worldwide, and the U.S. is heading toward 2.4%. Yet your grocery bill, rent, and energy costs still sting. The old “skip the latte” advice doesn’t cut it anymore.How to Save Money in 2026: Smart Personal Finance Strategies

In personal finance today, smart saving means adapting to an economy shaped by AI, lingering tariffs, and higher borrowing costs. The good news? With the right moves, you can protect your money and actually grow it. Let’s dive into practical, forward-looking strategies that go beyond generic tips.

Understanding the 2026 Economic Landscape

Global growth sits around 2.7–3.3%, with the U.S. expected at 2.1–2.6%. Mortgage rates hover near 6% (possibly dipping to 5.9% later), and the Fed funds rate lingers around 3.5–3.75%. High-yield savings accounts still pay 4%+ APY in many cases—far better than traditional banks.

The takeaway? Cash isn’t trash, but idle cash is. Inflation may be tamer, but targeted price pressures (energy, healthcare, housing) mean every dollar must work harder.

Build a Bulletproof Budget That Actually Sticks

Start with the classic 50/30/20 rule, but tweak it for 2026 realities:

- 50% → Needs (rent, groceries, utilities)

- 30% → Wants (dining out, streaming, travel)

- 20% → Savings + debt payoff

Better yet, try zero-based budgeting: assign every dollar a job. Apps make this effortless.

Top Budgeting Apps in 2026

| App | Best For | Pricing (2026) | Standout Feature |

|---|---|---|---|

| Monarch Money | Couples & net-worth tracking | $14.99/mo or $99.99/yr | Custom reports + shared dashboard |

| YNAB (You Need A Budget) | Zero-based budgeting | $14.99/mo or $109/yr | Goal tracking + “age of money” |

| Rocket Money | Subscription killers | Free → $7–14/mo | Bill negotiation + autosave |

| Quicken Simplifi | Families & bill forecasting | ~$2.99/mo (annual) | Personalized spending plan |

| Albert | Hands-off automation | $14.99–39.99/mo | AI-driven savings & expert chat |

Pro tip from my own testing: I switched to Monarch last year and caught $187/month in forgotten subscriptions within the first week.

Leverage AI and Automation to Save on Autopilot

AI budgeting tools now predict overspending, flag anomalies, and even negotiate bills. Set up:

- Automatic paycheck transfers (pay yourself first).

- Round-up features into high-yield savings.

- Rules like “if I spend over $50 on takeout, move $20 to savings.”

High-yield savings accounts (HYSA) remain your best friend. Top rates still hover around 4–5% in early 2026—compounding makes a real difference.

:max_bytes(150000):strip_icc()/BestHigh-YieldSavingAccounts-cf61d112a9254710acfed7122a31a417.jpg)

Build (or Rebuild) Your Emergency Fund

Aim for 3–6 months of essential expenses. In 2026’s uncertain job market (AI displacement + tariff ripple effects), 6–9 months feels safer for many.

Keep it in a HYSA earning 4%+. A $5,000 fund at 4.5% APY grows ~$225 in a year—free money.

Building Emergency Fund Family Savings Couple Stock Vector …

Cut Costs Without Feeling Deprived

Focus on the big three: housing, transportation, food.

- Housing: Negotiate rent, house-hack (rent a room), or refinance if rates drop below 6%.

- Transportation: Carpool apps, public transit passes, or switch to a cheaper insurance provider (shop every 6 months).

- Food: Meal prep, loyalty programs, bulk buying at Costco/Sam’s, and apps like Too Good To Go.

Other 2026-specific wins:

- Audit streaming bundles (many families save $30–50/mo by consolidating).

- Switch to energy-efficient appliances or smart thermostats—utility bills are rising in some regions.

- Use cash-back apps and credit cards strategically (but pay in full).

5 Healthcare Affordability Trends to Track in 2026 and Beyond …

Tackle Debt and Protect Your Credit

High-interest debt (credit cards at 20%+) is the enemy. Use the debt avalanche method: highest interest first.

Refinance student loans or auto loans if your credit score has improved. Keep utilization under 30% and check your free credit reports weekly via AnnualCreditReport.com.

Invest the Surplus Wisely

Once you have an emergency fund and high-interest debt is gone:

- Max employer 401(k) match (free money).

- Contribute to a Roth IRA or HSA.

- Consider low-cost index funds—U.S. equities still look strong despite volatility.

Final Thoughts: Small Habits, Big 2026 Wins

Saving money in 2026 isn’t about deprivation—it’s about intention, automation, and using tools that didn’t exist a decade ago. Start with one change today: open a HYSA, download a budgeting app, or automate a $50 transfer.

What’s your biggest money-saving win so far in 2026? Or what challenge are you facing? Drop a comment below—I read every one.

If you found this helpful, share it with a friend who’s also trying to get ahead this year. And if you’re ready for more, subscribe for monthly personal finance updates straight to your inbox.

Here’s to a wealthier, less stressful 2026. You’ve got this.

Also Read:Unlocking Build to Rent Loans.