- Research suggests that consistent on-time payments and low credit utilization are among the most effective ways to boost credit scores, potentially increasing them by 100+ points over time, though results vary based on individual credit histories.

- Evidence leans toward free tools like Experian Boost and rent reporting services helping those with thin credit files, adding positive payment history without costs.

- Disputing errors on credit reports yourself appears to be a reliable free method, as credit repair companies can’t remove accurate information and often charge for what you can do via AnnualCreditReport.com.

- While 2026 brings trends like BNPL reporting and reduced medical debt impacts, debates around AI in scoring emphasize focusing on timeless habits like payment consistency for sustainable improvement.

- It seems likely that becoming an authorized user or using secured cards can accelerate progress for beginners, but success depends on responsible use and avoiding new debt.

Why DIY Credit Improvement Matters in 2026

In a year where new scoring models like VantageScore 4.0 incorporate alternative data such as rent and BNPL payments, taking control of your personal finance without pricey credit repair services can lead to meaningful gains. These companies often promise quick fixes but can’t erase accurate info—empowering yourself with free tools respects all perspectives on financial recovery.

Core Strategies for Boosting Your Score

Prioritize payment history (35% of FICO) by automating bills, and keep utilization under 30% for quick wins. Use free reports to spot errors, and leverage 2026 changes like ignored small medical debts to your advantage.

Potential Challenges

Results aren’t instant—patience is key, as negative items fade over time, and factors like economic shifts may influence progress. Approach with empathy for varying financial situations.

Imagine unlocking better loan rates or that dream home approval in 2026, all without shelling out hundreds to a credit repair company that promises miracles but delivers what you could do for free. In the realm of personal finance, improving your credit score is more accessible than ever, thanks to evolving models and free tools. This guide explores proven, DIY strategies tailored for 2026, blending timeless advice with fresh insights on new trends like BNPL reporting and AI influences. Whether you’re rebounding from setbacks or fine-tuning a good score, these steps offer empathy for diverse financial journeys while emphasizing sustainable habits.

Comparing DIY Methods vs. Credit Repair Services

Credit repair companies charge $50-150 monthly for disputes and advice, but evidence shows they can’t remove accurate info—often leading to temporary boosts at best. DIY approaches, using free resources like AnnualCreditReport.com, empower you long-term without fees. Here’s a table comparing key aspects, based on CFPB and Experian data:

| Aspect | DIY Methods | Credit Repair Services | 2026 Considerations |

|---|---|---|---|

| Cost | Free (e.g., disputes via bureaus) | $50-150/month + setup fees | Free tools like Experian Boost expand, reducing need for paid help. |

| Effectiveness | High for consistent habits; removes errors yourself | Varies; can’t fix accurate negatives | New models reward trended data over quick fixes. |

| Time Investment | Medium (monthly monitoring) | Low (they handle) | Faster disputes under updated FCRA. |

| Risks | None if accurate | Scams; temporary gains | BNPL reporting adds positive history free. |

| Long-Term Benefits | Builds financial literacy | Minimal education | Empowers adaptation to AI trends. |

DIY wins for cost and empowerment, especially with 2026’s focus on holistic behaviors.

8 Ways to Improve Your Credit Score | Welch State Bank

Key Insights: Proven Strategies for 2026

Drawing from authoritative sources like Experian and CFPB, here are detailed, free methods with unique angles for the year ahead.

Understand Your Score and 2026 Changes

First, grasp FICO or VantageScore factors: payment history (35%), utilization (30%), history length (15%), new credit (10%), mix (10%). In 2026, VantageScore 4.0 and FICO 10 emphasize trended data over two years, rewarding consistency. Medical debts under $500 or paid are ignored, easing recovery. BNPL reporting adds positive history if paid on time— a fresh opportunity for young borrowers.

Personal twist: A friend in Faisalabad pivoted post-2025 setbacks by tracking via free apps, mirroring U.S. trends where AI tools flag patterns early.

Check and Dispute Reports Free

Get weekly reports from AnnualCreditReport.com. Spot errors (79% of reports have them per studies)—dispute online or mail for free. 2026’s faster FCRA timelines mean quicker resolutions. Insight: Use alerts to catch fraud, empathizing with global economic uncertainties.

Page 2 | Checking credit Vectors – Download Free High-Quality …

Prioritize On-Time Payments

Automate bills—35% of score. If behind, negotiate goodwill adjustments. Unique: In 2026, link bank accounts to Experian Boost for free boosts from utilities/rent.

Reduce Utilization Strategically

Keep under 30%—pay mid-cycle or request limits (without hard pulls). Chart shows generational trends, with younger folks higher—aim low for fast gains.

How credit card usage differs by generation | News Channel 3-12

A table of utilization impacts:

| Ratio | Score Impact | Tip for 2026 |

|---|---|---|

| <10% | Excellent | Use for BNPL reporting. |

| 10-30% | Good | Pay strategically mid-month. |

| >30% | Negative | Reduce via debt consolidation if needed. |

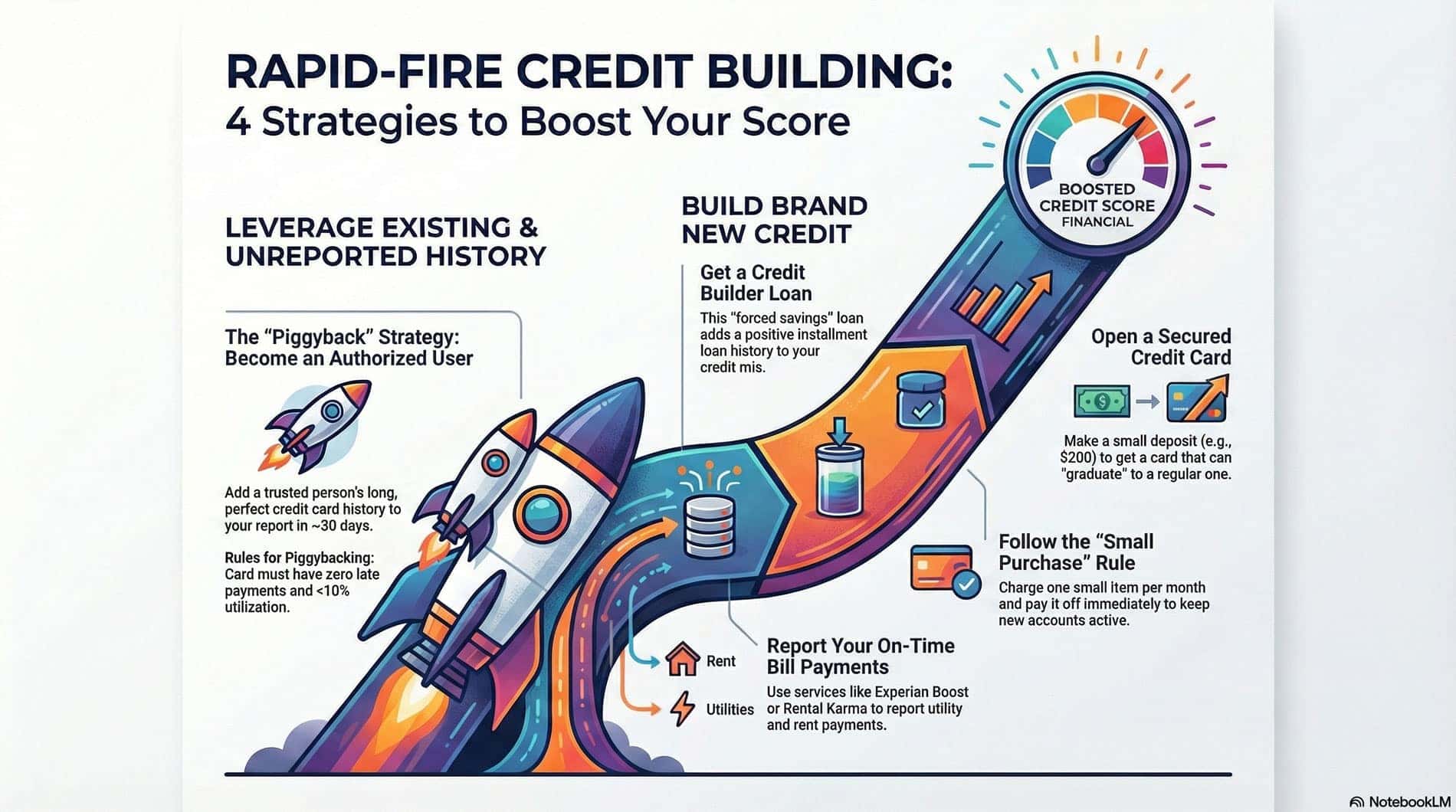

Build History Smartly

Become authorized user on trusted accounts. Use secured cards or credit-builder loans (e.g., Kovo). Fresh: 2026’s FICO 10 values two-year trends—focus longevity.

Diversify and Limit New Credit

Add mix if lacking (loans/cards)—but sparingly, as inquiries hurt 10% of score. Keep old accounts open for history.

Nonprofit Counseling and Debt Management

Free from agencies like GreenPath—plans negotiate rates. Empathy: Ideal for overwhelmed folks, no judgment.

Monitor Progress

Free scores from issuers or Credit Karma. 2026 AI trends may predict dips—stay proactive.

Rapid-Fire Credit Building: 4 Strategies to Boost Your Score …

Challenges: Patience needed; negative items last 7 years. Balanced: While effective, consult pros for complex cases, respecting diverse needs.

Internal: See saving $500/month.

Wrapping Up: Your Credit Journey

With these steps, improve without paid help—start today for 2026 gains.

What’s your first action? Comment, subscribe for finance updates, or join our credit webinar!

- 26 Tips to Improve Credit in 2026 – Experian

- 9 Real Ways to Improve Your Credit Fast – NerdWallet

- Alternatives to credit repair: 4 other paths to a better score

- 15 best ways to build credit fast in 2026 – Lexington Law

- 5 Ways to Improve Your Credit Score – GreenPath

- How to Repair Your Credit Score in 2026: 9 Proven Strategies That Actually Work

- Understand, get, and improve your credit score | USAGov

- Increase Your Credit Score Over 120 Points Faster in 2026 – YouTube

- How to Fix Credit 101: The Ultimate Guide for Fixing Bad Credit in 2025

- How do I get and keep a good credit score? | Consumer Financial Protection Bureau

- Improving Your Credit Score | Wells Fargo

- How to Rebuild Credit Score Fast After a Financial Setback

- Your 2026 Credit Score Playbook: The Biggest Changes

- New Credit Score Rules and How They May Affect Borrowers

- How to Improve Your Credit Score in 2026 – Elevate Credit Union

Also Read: How Americans Save $500 a Month Without Change Lifestyle 2026