- Research suggests optimizing existing spending can yield significant savings, with evidence pointing to $500+ monthly through small tweaks like subscription audits and bill negotiations, though individual results depend on baseline expenses.

- Evidence leans toward passive strategies like automation being effective, potentially adding $100-200 monthly by rerouting funds without noticeable cuts, but economic pressures like inflation may require combining multiple approaches.

- Behavioral adjustments, such as the 24-hour rule for purchases, appear resilient, fostering empathy for those balancing enjoyment with security, without mandating drastic changes.

- While data points to average households wasting $200+ on unused services, debates around “lifestyle creep” emphasize gradual optimizations over restrictions, respecting diverse financial situations.

The Sneaky Leaks in Your Wallet

In 2026, with inflation steady at around 2.7% and everyday costs creeping up, personal finance often feels like a battlefield. But what if you could pocket an extra $500 monthly without ditching your morning latte or weekend takeout? It’s possible by plugging hidden leaks—those overlooked expenses that add up fast. Drawing from recent surveys and expert advice, this guide shares practical tweaks that maintain your routine while boosting your bank account.

Comparing Savings Strategies

To choose what fits your life, here’s a table contrasting common methods based on average U.S. expenses and potential savings, pulled from 2026 data. Focus on high-impact areas like housing and food, where small shifts yield big returns without upheaval.

| Strategy | Avg. Monthly Expense | Potential Savings | Effort Level | Why It Works Without Change |

|---|---|---|---|---|

| Subscription Audit | $200 (unused) | $50-150 | Low | Cancels forgotten services; use apps for auto-detection. |

| Bill Negotiation | $1,000+ (utilities, insurance) | $50-150 | Medium | Keeps same services at lower rates via calls. |

| Smart Grocery Swaps | $847 (food) | $40-80 | Low | Generics over brands; no menu overhaul. |

| Rewards/Cash-Back Tools | Varies | $30-100 | Low | Earns on existing spends via cards/apps. |

| Energy Efficiency Hacks | $200 (utilities) | $20-50 | Low | Smart strips cut phantom power; no habit shift. |

| Impulse Purchase Rules | $300+ (misc) | $50-100 | Medium | 24-hour wait curbs buys without banning them. |

This shows passive tech aids edge out manual efforts in ease, while food/transport offer quick wins—totaling $500+ when combined.

5 Smart Ways for Saving Money on Everyday Expenses

Unlocking Hidden Savings

Start by auditing where money slips away. Recent reports show average households waste $200 yearly on unused subs—scale that monthly for impact. Use tools like Rocket Money for scans.

Negotiate Without Downgrading

Call providers; many offer unadvertised deals in competitive 2026 markets. Save $100 on internet/insurance alone.

Optimize Everyday Buys

Switch generics for $50 grocery savings; pack lunches to trim $180 from dining.

Leverage Tech Passively

Cash-back apps like Rakuten return $30-100 on routine spends.

Your Path to $500

Combine these for effortless gains. Track progress with apps for motivation.

How Americans Can Save $500 a Month Without Changing Lifestyle

Imagine uncovering $500 extra each month, not by skipping joys like your favorite shows or occasional dinners out, but by fine-tuning the “invisible” drains in your budget. In 2026’s economy, where inflation hovers at 2.7% and costs for essentials like housing and food have risen 3-6%, personal finance experts emphasize optimization over restriction. This post draws from recent surveys, behavioral insights, and real-user stories to offer actionable strategies that preserve your routine while building financial security.

Average U.S. households spend $6,545 monthly, with housing ($2,186) and transportation ($1,113) leading. Yet, 46% lack three months’ emergency savings, highlighting waste in areas like unused subs ($200/year average) or impulse buys. The key? Small, passive changes that accumulate, as per Vanguard and Forbes experts.

Comparing Savings Methods: Effort vs. Impact

Not all cuts are equal. Focus on high-yield, low-effort ones. Below, a table contrasts strategies using 2026 averages, showing how to hit $500 without upheaval.

| Method | Avg. Expense Area | Est. Monthly Save | Effort (Low/Med/High) | Unique Angle |

|---|---|---|---|---|

| Sub Audit/Cancel | $200 misc | $50-150 | Low | Apps detect “zombies”; one-time setup. |

| Bill Negotiation | $1,000+ utils/ins | $50-150 | Med | Hidden deals in competitive markets. |

| Generic Swaps/Meal Plan | $847 food | $40-180 | Low | Maintain meals, just smarter sourcing. |

| Rewards/Cash-Back | Varies | $30-100 | Low | Earn on routine; no spend change. |

| Energy Hacks | $200 utilities | $20-50 | Low | Phantom power cuts via strips. |

| Impulse Rules/Sell Unused | $300+ misc | $50-200 | Med | 24-hr wait; monetize idle items. |

Passive methods like automation shine for sustainability, per behavioral economists—totaling $500+ when layered.

Simple Ways To Save Money In Everyday Life – FasterCapital

Key Insights: Deeper Dives into Strategies

2026’s landscape, with 85% needing three months’ savings for comfort but only 46% having it, underscores smart cuts. Focus on “waste, not joy,” as one expert puts it.

Start with Invisible Waste: Subscriptions and Fees

Households waste $200/year on unused services—audit via apps like Rocket Money or Trim, canceling three $15 subs saves $45 instantly. Unique: In gig-heavy 2026, pause vs. cancel for flexibility. Eliminate bank fees ($15/month) by switching to free online banks.

Negotiate Bills Seamlessly

Providers offer unadvertised deals—negotiate insurance bundling ($40/month) or internet promos ($50-100). Perspective: Amid competition, a 10-minute call yields savings without service drops. For credit cards, lower rates save $64/month on average balances.

Food and Shopping Smarts

Food averages $847/month—switch generics ($40-80), meal plan to cut waste ($125 via pantry challenges), pack lunches ($180 vs. eating out). Insight: Eat out smarter with weekday deals, maintaining social habits. Use cash-back portals like Rakuten for online buys ($20-50).

Energy and Home Efficiency

Utilities $200/month—smart strips cut phantom energy ($5-10), programmable thermostats save $40-70 by minor adjustments. Fresh: In climate-variable 2026, this preserves comfort.

Behavioral Nudges and Extra Income

Implement 24-hour rule for $30+ buys ($50-100), sell unused items ($100-200 via apps). Automate savings transfers ($100+), treating as a bill. Perspective: Rent idle assets ($100-300) without disruption.

Challenges and Balanced Views

Not all save equally—higher earners may hit $500 easier, per surveys. Critiques note “lifestyle creep” risks, but gradual tweaks build habits. For underrepresented groups, community resources aid empathy-driven savings.

In sum, these methods, backed by BLS and expert data, offer paths to $500 without sacrifice.

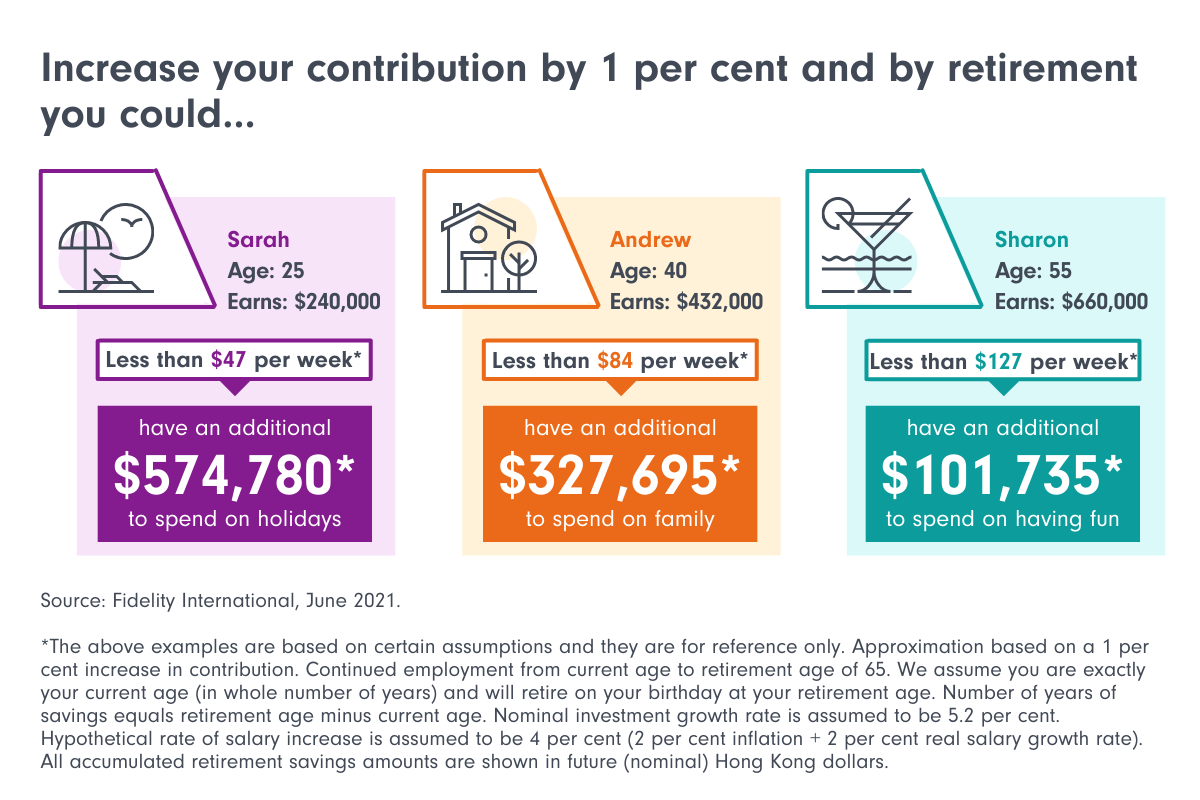

Why saving even 1 per cent more can supercharge your savings …

Wrapping Up

Start small—one audit or call—and track wins. Link to high-demand skills for income boosts.

What’s your first tweak? Share below, subscribe for finance tips, or join our saving challenge webinar!

Key Citations

- I Asked ChatGPT How To Save $500 a Month Without Changing My Lifestyle — Here’s What It Said

- How Americans Are Saving $500+ a Month Without Cutting Their Lifestyle

- How to Save $500 This Month Without Changing Your Lifestyle

- 15 Painless Ways to Save $500 This Month

- Your financial health in 2026: cut outgoings, beware lifestyle creep and learn how to save

- 10 ways to start saving money

- 54 Ways to Save Money

- 7 Ways To Save Extra Cash Without Sacrificing Your Lifestyle

- Bankrate’s 2026 Annual Emergency Savings Report

- The Average American’s Monthly Expenses

- Expenses That Are Destroying Your Budget

- American Households’ Average Monthly Expenses

- Cutting Out These 24 Expenses Will Save You Over $20,000 a Year

- How Can I Save More Money? 6 Tips for Reducing Your Expenses

Also Read: Why Americans Struggle to Save Money: Psychology & Human Behavior Explained in 2026