- Evidence suggests social media scrolling is a major time sink, with Americans averaging over 2 hours daily, potentially leading to lost productivity equivalent to weeks annually, though individual experiences vary.

- Impulse online shopping appears common, with stats indicating 89% of shoppers make unplanned buys, costing billions yearly, but economic pressures may curb this for some.

- Forgotten subscriptions lean toward financial waste, as surveys show U.S. households average $200 yearly on unused services, highlighting the need for better management amid subscription fatigue.

- While data points to digital distractions draining work efficiency, debates around tech’s role emphasize balancing connectivity with focus, respecting diverse workplace dynamics.

Why Digital Habits Matter

Research indicates Americans spend over 6 hours daily on digital devices, per We Are Social’s Digital 2026 report. This connectivity boosts convenience but often wastes time and money through habits like endless scrolling or unchecked spending. Addressing these can enhance digital life & productivity without drastic changes.

Common Culprits

From Pew’s 2025 social media study, about half of adults visit platforms daily, leading to fragmented attention. Similarly, Capital One Shopping notes 89% make impulse buys, averaging $282 monthly. Subscriptions add up too, with Self Financial reporting a drop in average holdings due to cost awareness.

Quick Fixes

Start by tracking screen time via apps, auditing subscriptions quarterly, and setting shopping limits. These steps, informed by Deloitte’s consumer insights, can reclaim hours and dollars.

Navigating the Digital Drain: Habits Costing Americans Time and Money

In an era where screens dominate daily routines, digital habits are reshaping how Americans spend their time and resources. A compelling hook: Imagine reclaiming nearly 12 hours monthly lost to tech glitches alone, as TeamViewer’s 2025 report reveals. This underscores a broader issue in digital life & productivity—habits that promise efficiency but often deliver distraction and debt. With inflation lingering and AI accelerating online temptations, understanding these patterns is crucial for financial and mental well-being.

Comparing Digital Time Sinks: Social Media vs. Shopping vs. Subscriptions

To grasp the impact, let’s compare key habits using data from recent reports. Social media emerges as a prime time waster, while shopping and subscriptions hit wallets harder. Here’s a table based on stats from DemandSage, Capital One Shopping, and Self Financial:

| Habit | Average Time Waste (Daily) | Annual Cost Estimate | Key Driver | Growth Projection (2026) |

|---|---|---|---|---|

| Social Media Scrolling | 2 hours 9 minutes | $0 (direct), but productivity loss ~$1T globally | Dopamine hits from feeds | Up 1.7% users, time peaks |

| Impulse Online Shopping | Varies (minutes per session) | $3,381 per person | Discounts (72% influenced) | 40% of e-commerce sales |

| Forgotten Subscriptions | Minimal active time | $200 per household | Subscription fatigue (22% feel undervalued) | Churn at 5.5% monthly |

This comparison highlights social media’s time dominance versus shopping’s financial bite, per eMarketer forecasts. Trades like HVAC techs report less vulnerability due to hands-on work, but even they face app-based distractions.

Time Wasting stock vector. Illustration of transportation – 58453353

Key Insights: Unpacking the Habits

Delving deeper, 2026 data from We Are Social shows U.S. digital time at record highs, with AI tools like ChatGPT (22% usage) both aiding and distracting. Unique perspective: Amid economic optimism (Intuit’s survey notes 49% plan mindful spending), habits persist due to “little treat culture.”

Endless Social Scrolling: The Time Thief

Pew’s 2025 study reveals half of adults check platforms daily, averaging 2+ hours. Statista projects this as 141 minutes globally, but U.S. figures hover higher. Fresh insight: Gen Z’s “chronically offline” trend (CNBC) counters this, with 25% deleting apps for mental health. Personal angle: A Seattle professional shared on X ditching TikTok reclaimed 3 hours weekly for side hustles.

- Daily U.S. average: 129 minutes (DemandSage).

- Productivity loss: Equivalent to 36 days/year (YouTube short).

- Counter: Set app limits, per Deloitte’s mindful spending push.

SocialMedia logic

Impulse Online Buys: The Wallet Weakener

Capital One’s 2025 stats: 89% make impulse buys, averaging 6 monthly at $282. Invesp notes 40% of e-commerce from impulses. Perspective: Post-pandemic, 70% buy due to discounts (Salsify), but inflation curbs 48% (Slickdeals). Gen Z leads at 70%, per AWISEE.

- Regret rate: 85% (Chain Store Age).

- Evening peaks: 42% between 6-9 PM.

- Fix: 30-day lists (FNBSF).

A table of impulse triggers:

| Trigger | Influence Rate | Source |

|---|---|---|

| Discounts | 72% | Capital One |

| Urgency tactics | 70% | Liquid Web |

| Online ads | 14% impulse buys | Chain Store Age |

The science of shopping addiction: what makes people buy loads of …

Subscription Overload: Silent Money Leak

Self Financial: Households cut to 2.8 subs, wasting $200/year on unused. Recurly’s 2026 report: 52% canceled last year, 51% for low usage. Insight: “Pause” features up 57%, reducing churn (Recurly). Controversy: Streaming churn at 5.5% (Broadband TV), vs. software’s 3.5% (Whop).

- Average subs: 8.2 (Astute Analytica).

- Fatigue: 22% feel undervalued (MarketWatch).

- Tip: Audit via apps like Rocket Money.

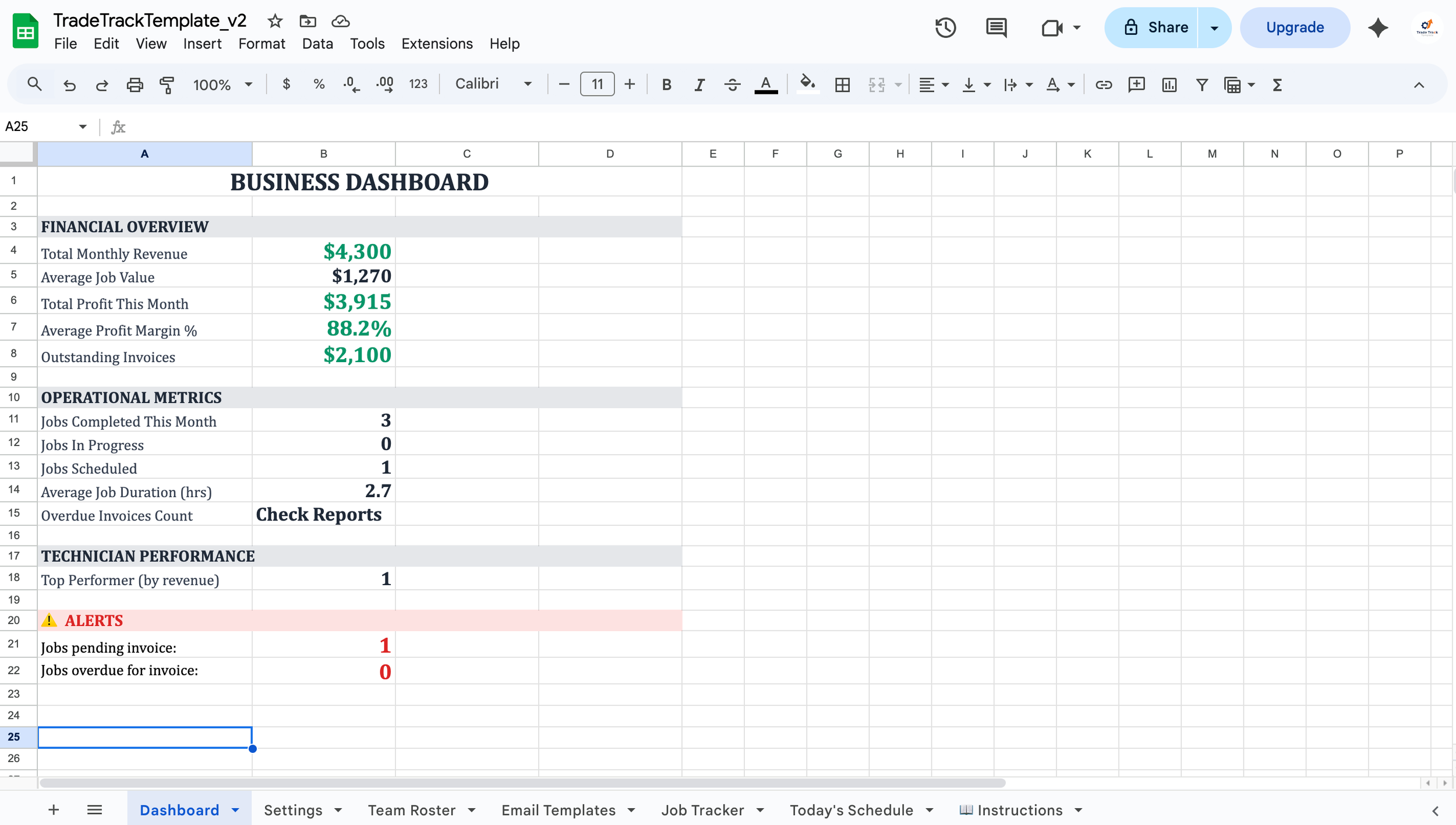

TradeTrackTemplate

Work Distractions: Productivity Pitfalls

TeamViewer’s report: 12 hours/month lost to friction. Insightful: 79% distracted hourly. Balanced: AI could help, but risks overload (Wharton).

- Email checks: 36/hour (Entrepreneur).

- Cost: $650B annually (BusinessDasher).

Reclaiming Control: Strategies for Better Digital Life

Embrace “No Buy 2026” (FNBSF) or mindful spending (Intuit). Internal link: Explore high-demand skills to turn saved time into income.

Wrapping Up

In 2026, these habits cost billions, per Motley Fool. Start small for big gains in digital life & productivity.

What’s one habit you’ll ditch? Share below, subscribe for tips, or join our webinar on mindful tech use!

Key Citations

- We Are Social: Digital 2026 in the U.S.

- CNBC: Young People Swapping Social Media

- Intuit: 2026 Financial Forecast

- FNBSF: No Buy 2026

- Deloitte: State of US Consumer January 2026

- Pew Research: Americans’ Social Media Use 2025

- DemandSage: Average Time Spent on Social Media

- Capital One Shopping: Impulse Buying Statistics 2025

- Invesp: State of Impulse Buying 2025

- Chain Store Age: Drivers of Impulse Online Purchases

- Salsify: Why 70% Can’t Resist Impulse Buys

- Slickdeals: Impulse Spending Survey 2023

- VICE: Subscription Era Over

- MarketWatch: Subscription Fatigue

- Whop: Subscription Statistics 2026

- Astute Analytica: Subscription Billing Market

- TeamViewer: Impact of Digital Friction

- TeamViewer: Dysfunctional Tech Press Release

- Circles: Hidden Productivity Drain

- Wharton: AI Efficiency Trap

- Fortune: Workplace Attention Span

- Motley Fool: Wasteful Spending Habits

Also Read: Beginner-Friendly Side Hustles That Work in USA 2026