Imagine opening your mailbox to a $2,000 car repair bill while your credit card balance already sits at $11,000. For millions of Americans, this isn’t a nightmare—it’s Tuesday. In 2026, the average household carrying debt owes roughly $179,000, and nearly half of those with credit card balances expect them to grow this year.Personal Finance Tips Every American Knows for a Secure Future

Personal finance isn’t about getting rich quick. It’s about building a life where money works for you, not against you. Here are the strategies that actually move the needle—backed by the latest data and real-world lessons from people who’ve turned their finances around.

The 2026 Financial Reality Check

U.S. household debt hit $18.59 trillion in late 2025. Credit card balances alone climbed 4.3% year-over-year, with the average indebted household carrying $11,413 on revolving cards. Only about 46% of Americans have enough emergency savings to cover three months of expenses, and 24% have none at all.

Here’s how debt breaks down by generation (mid-2025 figures):

| Generation | Age Range | Average Total Debt |

|---|---|---|

| Gen Z | 18–28 | $34,328 |

| Millennials | 29–44 | $132,280 |

| Gen X | 45–60 | $158,105 |

Mortgages still dominate (70%+ of total debt), but credit cards and auto loans are the silent killers because of sky-high interest rates.

![U.S. Household Debt Composition (2003-2024) [oc] : r/dataisbeautiful](https://preview.redd.it/u-s-household-debt-composition-2003-2024-v0-ewhy8vd1m66d1.png?auto=webp&s=fe29c4747f344a532bc0c4d4d4096066a250262e)

U.S. Household Debt Composition (2003-2024) [oc] : r/dataisbeautiful

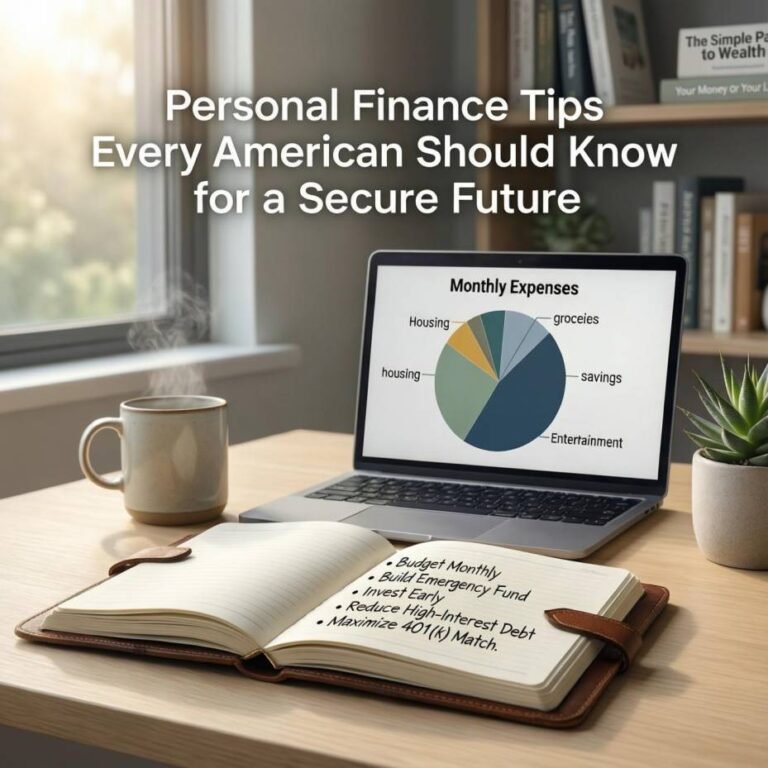

Build a Budget That Actually Works (The 50/30/20 Rule, Updated)

The classic 50/30/20 split still holds: 50% needs, 30% wants, 20% savings/debt. But in 2026, tweak it for reality.

- Needs → 50–55% (housing, food, utilities, minimum debt payments)

- Wants → 25–30% (cut here first when money gets tight)

- Future You → 20–25% (emergency fund, retirement, extra debt payoff)

Track for 30 days using a free app like YNAB or Monarch. Most people discover they’re leaking $200–400/month on “small” subscriptions and dining out.

Personal Expense Report Pie Chart Template | Visme

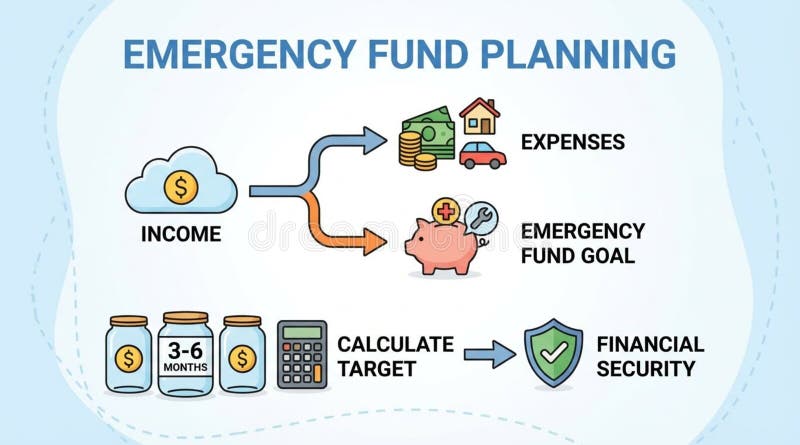

The Emergency Fund That Saves Marriages and Sanity

Experts still say 3–6 months of expenses. If you’re self-employed or in a volatile industry, aim for 9–12.

Start stupidly small: $1,000 “oh-shit” fund first. Then build the full cushion in a high-yield savings account (many still pay 4%+ in early 2026).

Pro tip: Automate the transfer the day after payday. Out of sight, out of mind—and suddenly you’re not panicking when the transmission dies.

Emergency Expenses Stock Illustrations – 1,228 Emergency Expenses …

Debt Payoff: Snowball vs. Avalanche (Choose Your Fighter)

Debt Snowball (Dave Ramsey style): Pay smallest balances first for quick wins and motivation. Debt Avalanche: Pay highest-interest debt first to save the most money mathematically.

Real talk: If you need psychological momentum (most people do), go snowball. If you’re a spreadsheet nerd who hates paying extra interest, go avalanche.

Here’s the side-by-side:

Debt Avalanche vs Debt Snowball Method: Know the Difference

Either way, stop the bleeding: Freeze credit cards in a bowl of water if you must.

Retirement: Start Ugly, Stay Consistent

The average 401(k) balance for people in their 50s is still shockingly low for many. Yet someone who invests $5,000/year from age 25 to 65 at a conservative 7% return ends up with over $1 million.

Compound interest is the closest thing to magic most of us will ever see:

How Compound Interest Affects Retirement Funds

Max your 401(k) match first—it’s free money. Then consider a Roth IRA if you qualify. In 2026 contribution limits are $7,000 ($8,000 if 50+).

Invest Beyond Retirement (Without Becoming a Day Trader)

Once you have your emergency fund and high-interest debt handled, put money to work:

- Low-cost index funds (VTSAX, VTI, or target-date funds)

- HSA if you have a high-deductible health plan (triple tax advantage)

- Real estate via REITs or house-hacking if you’re ready

The boring strategy wins 90% of the time.

Protect Everything You’ve Built

- Keep your credit score above 740 (pay on time, keep utilization under 30%)

- Review insurance annually (life, disability, umbrella policies matter more than most realize)

- Have a will and basic estate plan—even if you’re “young”

Your Next 30 Days

Pick ONE thing from this post and do it this month:

- Track every dollar for 30 days

- Build or add $500 to your emergency fund

- Increase your 401(k) contribution by 1%

- Pay an extra $100 toward your highest-interest debt

Small actions compound faster than you think.

What’s the one personal finance habit that’s made the biggest difference for you? Drop it in the comments—I read every single one.

If you found this helpful, share it with a friend who’s stressed about money. And subscribe below for monthly updates on rates, tax changes, and strategies that actually work in the real world.

Your future self is already thanking you.

Also Read: 2026 Master Simple Personal Finance Tips Every American Should Know