Why Personal Finance Feels Harder Than Ever in 2026

Your paycheck arrives, but by the time rent, groceries, and gas are paid, there’s barely anything left. Sound familiar?2026 Master Simple Personal Finance Tips Every American Should Know.

In 2026, U.S. household debt sits at a staggering $18.59 trillion, with the average household carrying over $105,000 (including mortgages). Credit card balances alone top $1.23 trillion, and only 47% of Americans can cover a $1,000 emergency without borrowing.

Inflation has cooled to around 2.7%, yet everyday costs still sting. Many feel stuck between rising prices and stagnant wages.

The good news? Small, intentional changes in personal finance can create real momentum. These aren’t flashy get-rich-quick ideas—they’re battle-tested strategies adapted for today’s realities, drawn from recent data and expert insights.

Let’s explore what’s working right now.

The Current Financial Landscape: A Quick Reality Check

Before diving into tips, let’s look at where we stand:

- Emergency savings gap: Just 46% have three months’ expenses saved; 24% have zero.

- Debt reality: Average consumer debt hit $104,755 in mid-2025. Credit cards average ~$5,595 per cardholder.

- Retirement shortfall: Many believe they’ll need ~$824,000 to retire comfortably, yet median savings lag far behind.

These numbers aren’t meant to scare you—they highlight why simple, consistent habits matter more than ever.

Comparison: Debt Snowball vs. Avalanche – Which Wins in 2026?

When tackling debt, two proven methods dominate conversations:

| Method | How It Works | Best For | Potential Drawback |

|---|---|---|---|

| Snowball | Pay smallest balances first | Motivation & quick wins | May cost more in interest over time |

| Avalanche | Pay highest-interest debt first | Saving the most money long-term | Slower visible progress |

In today’s high-interest environment (average credit cards ~20%+ APR), the avalanche method mathematically wins. But if you need psychological momentum to stay motivated, start with snowball. Many hybrid users begin with snowball for small wins, then switch.

Key Personal Finance Tips Every American Should Apply Today

1. Build (or Rebuild) Your Emergency Fund First

Aim for 3–6 months of essential expenses in a high-yield savings account (many now offer 4%+ APY).

Start small: Automate $50–100 per paycheck. Even $1,000 creates breathing room.

Building an Emergency Fund stock illustration. Illustration of …

Pro tip for 2026: With potential tariff-driven price increases, treat your emergency fund like insurance against “what if” moments—medical bills, job loss, or sudden repairs.

2. Adopt a Flexible 50/30/20 Budget (or Customize It)

The classic rule:

- 50% Needs (rent, food, utilities, minimum debt payments)

- 30% Wants (dining out, hobbies, subscriptions)

- 20% Savings & debt payoff

:max_bytes(150000):strip_icc():format(webp)/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

SIMPLE: The “50-30-20” Budget Rule of Thumb | The Leading Business …

In high-cost areas or with inflation pressure, many shift to 60/20/20 or 70/20/10. The key isn’t perfection—it’s awareness. Track for one month, then adjust.

3. Make Debt Payoff Automatic and Aggressive

Prioritize high-interest debt (credit cards first). Use windfalls (tax refunds, bonuses) to make lump-sum payments. Consider balance transfers to 0% intro APR cards if your credit allows.

Fresh perspective: In the gig-economy era, treat side-hustle income as “debt-destroyer” money—100% allocated until high-interest balances disappear.

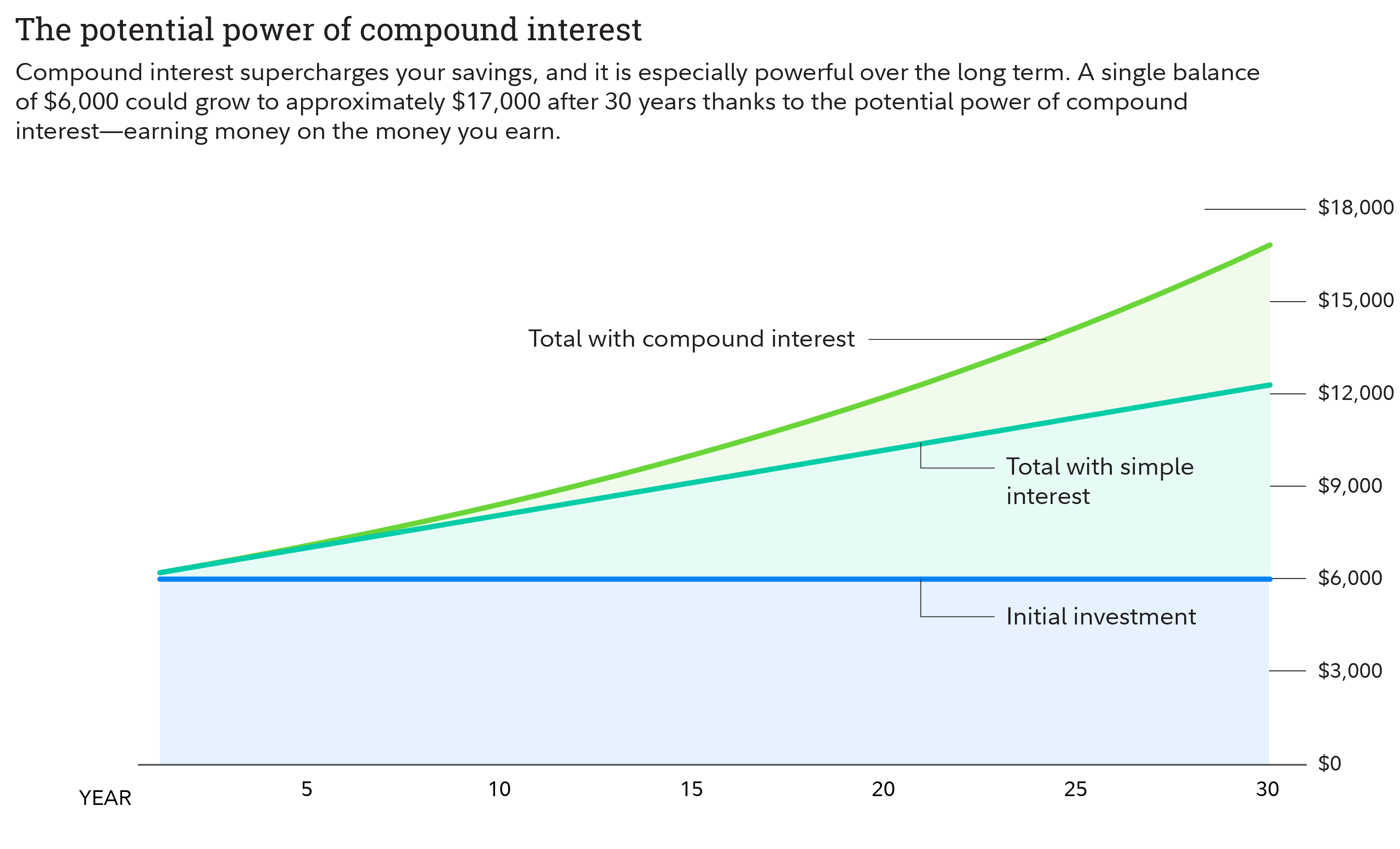

4. Start Investing Early—Even If It’s Just $50/Month

Compound interest is the closest thing to financial magic.

What is compound interest? | Fidelity

Example: $200/month at 7% average return grows to ~$500k+ over 40 years. Start at 25 vs. 35? That decade difference can mean hundreds of thousands.

Low-cost index funds or target-date retirement funds via your 401(k) or IRA are perfect for beginners. Max your employer match—it’s free money.

5. Protect Your Future: Retirement, Credit, and Insurance

- Contribute enough to get your full 401(k) match.

- Check your credit report annually (free at AnnualCreditReport.com).

- Review insurance—life, health, disability, umbrella policies. One gap can wipe out years of progress.

6. Cultivate “Stealth Wealth” Habits

Cut subscription creep (average American spends $1,080/year). Cook more, negotiate bills, buy quality over quantity. These micro-saves compound faster than most realize.

Conclusion: Your 2026 Personal Finance Action Plan

You don’t need a six-figure income to build wealth—you need consistency, awareness, and starting today.

Pick one tip from this post and implement it this week: Open that high-yield savings account, set up automatic debt payments, or review your budget.

The economy will keep changing. Tariffs, rates, and markets will fluctuate. But control over your spending, saving, and investing habits? That’s always within reach.

What’s your biggest personal finance win (or struggle) right now? Drop a comment below—I read every one. And if this helped, share it with a friend who needs it. Your future self (and theirs) will thank you.

Subscribe for more straightforward personal finance strategies delivered monthly—no fluff, just actionable steps.

Here’s to building a financially secure 2026—one smart move at a time.

Also Read: 10 Personal Finance Tips Every American Should Know But Most Ignore in 2026