It’s February 2026, and the numbers still sting. Nearly half of Americans (48%) say they live paycheck to paycheck—including 38% of households earning $100,000+. Only 46–55% have enough emergency savings to cover three months of expenses, and just 47% could handle a $1,000 surprise without borrowing. Yet the advice that could fix this sits ignored on nightstands, bookmarks, and “someday” lists.10 Personal Finance Tips Every American Should Know But Most Ignore in 2026

These aren’t flashy hacks. They’re the quiet, uncomfortable truths that separate the financially secure from the perpetually stressed. Here are the 10 most overlooked personal finance tips in America right now—and exactly why they matter in 2026.

1. Build an Emergency Fund That Actually Matches Your Life (Not the Generic “3–6 Months”)

The classic rule sounds simple until you realize your “three months” looks nothing like your neighbor’s. A family of four in a high-cost city needs far more than a single renter in a low-tax state.

:max_bytes(150000):strip_icc()/HowMuchShouldYouHaveinanEmergencyFund-new-2b31d05ddf2b44b4ae48ce83e71c84e4.jpg)

Recent data shows 24% of Americans have zero emergency savings, and 68% worry about covering bills if they lose income. The real fix? Calculate your actual fixed costs (rent, groceries, insurance, minimum debt payments) and target 3–6 months of those. Start with $1,000, then automate the rest.

2. Automate Savings Like It’s a Non-Negotiable Bill

The people who succeed with money don’t “remember” to save—they make it automatic. Set up transfers the day your paycheck hits: 10% to high-yield savings, 10–15% to retirement, 5% to a “future me” fund.

In 2026, with high-yield accounts still paying 4%+, automation turns good intentions into real wealth. The alternative? Watching your money disappear into subscriptions and “quick Amazon orders.”

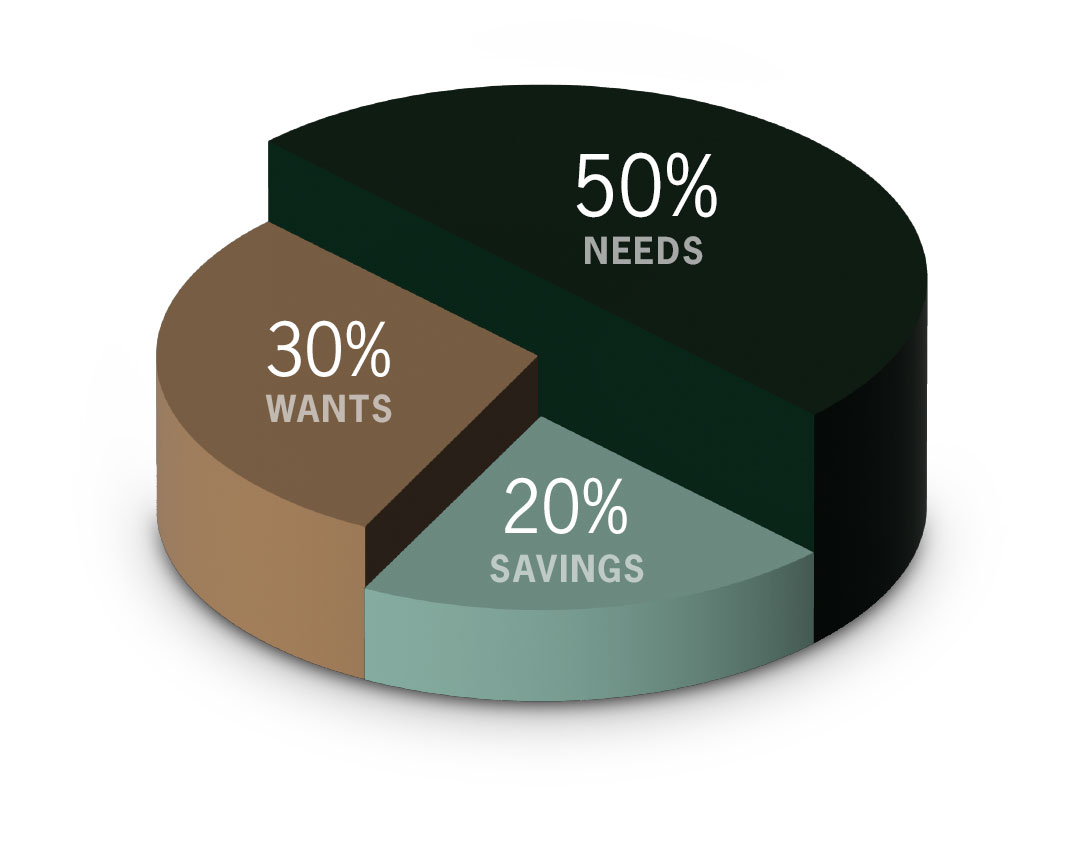

3. Ditch the Guilt-Trip Budget for a Conscious Spending Plan

Strict budgets fail because they feel like punishment. Ramit Sethi’s approach (which I’ve seen work for friends burned out on apps) is simpler: Keep fixed costs under 50–60% of take-home pay, automate 10% savings + 10% investments, and spend the rest guilt-free.

The 50/30/20 rule is a solid starting point, but the key is making the “guilt-free” portion intentional—not endless scrolling and regret.

4. Pay Off High-Interest Debt Before Chasing “Investing Opportunities”

33% of Americans carry more credit card debt than emergency savings. Carrying 20%+ APR debt while investing in the stock market is like running on a treadmill with a backpack full of bricks.

Pay the debt first (especially anything above 7%). Then invest. The math is brutal but clear.

5. Never Leave Free Money on the Table—Maximize Employer Matches

If your company matches 401(k) contributions, you’re turning down a 50–100% instant return. Yet millions still contribute only enough to get the match—or skip it entirely.

In 2026, with contribution limits at $23,500 (plus catch-up for 50+), this is the single highest-ROI move most people can make.

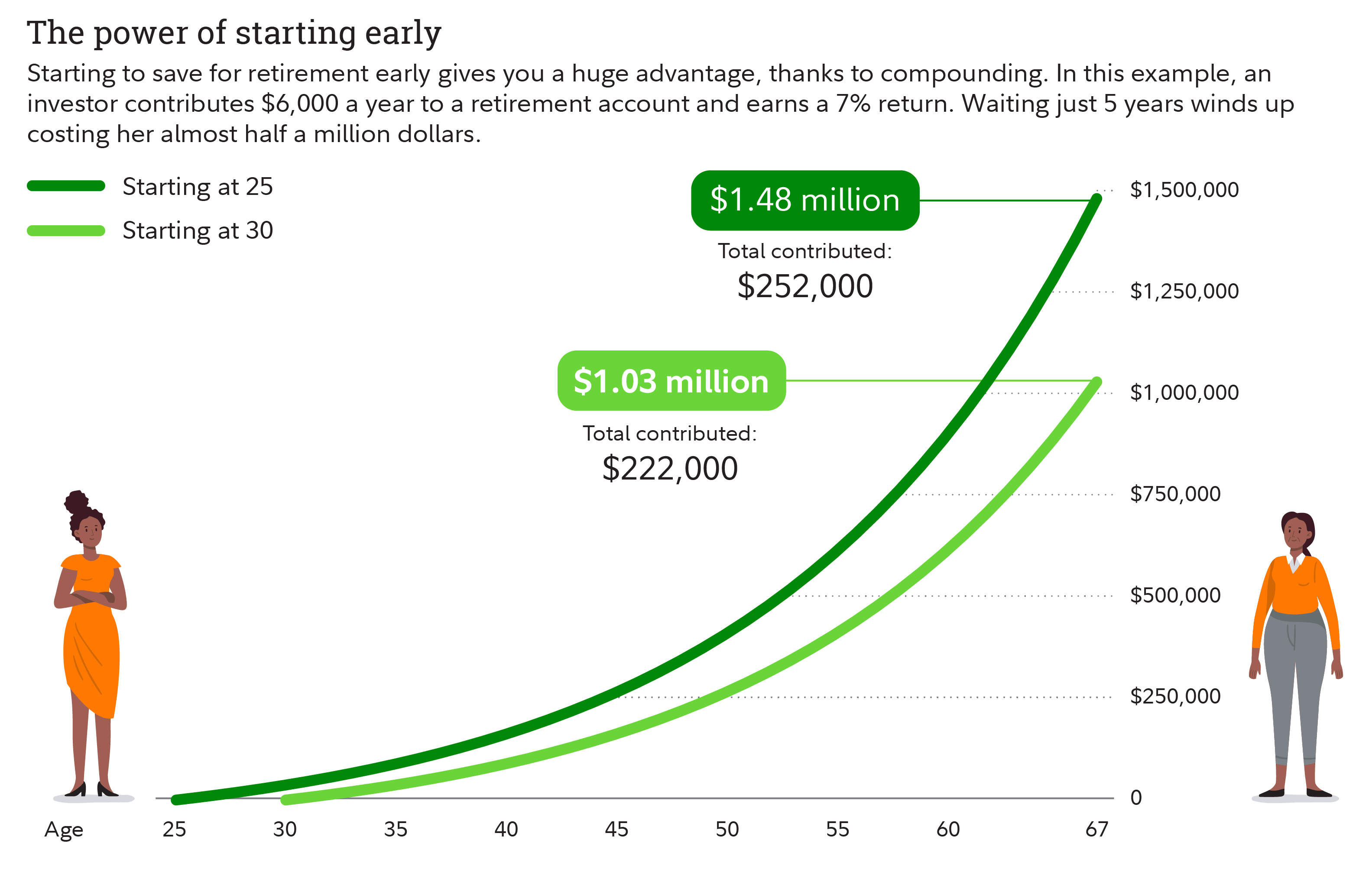

6. Start Investing Early—Compound Interest Doesn’t Care About Your “Timing”

Waiting five years to start can cost you nearly half a million dollars by retirement.

The person who invests $6,000/year from age 25 ends up with ~$1.48 million at 67 (7% return). The person who waits until 30 ends up with $1.03 million—even though they invest only $30,000 less. Time is the real wealth multiplier.

7. Track Your Net Worth Monthly (Not Just Your Bank Balance)

Income feels good. Net worth tells the truth. Subtract debts from assets every month. Watching that number climb—even slowly—creates powerful motivation and catches lifestyle creep early.

8. Guard Against Lifestyle Inflation When Raises Hit

The raise arrives. Suddenly the car payment, bigger apartment, and “deserved” vacation feel justified. Six months later, you’re back to zero extra cash.

The people who build wealth treat raises like this: 50% to savings/investments/debt, 50% to life. It’s boring. It works.

9. Review Insurance and Protections Every Year

Most Americans are either over-insured on things that don’t matter or dangerously under-insured on the big ones (disability, umbrella liability, proper term life). One afternoon of shopping can save thousands and protect everything you’ve built.

10. Treat Financial Education Like a Subscription You Can’t Cancel

The landscape changes fast—tax laws, AI tools for budgeting, new high-yield accounts, crypto regulations. The people who stay ahead read one good finance book or listen to one solid podcast per quarter. Knowledge compounds too.

Quick Comparison: What Most People Do vs. What Changes Everything

| Ignored Habit | Common Reality (2026 Data) | What Actually Moves the Needle |

|---|---|---|

| Emergency fund | 24% have none | 3–6 months of real expenses automated |

| Budgeting | Strict apps → burnout | Conscious spending plan + automation |

| Debt vs. investing | Credit card debt > savings | Pay >7% debt first, then invest |

| Retirement contributions | Just enough for match (or none) | Max match + increase 1% every raise |

| Compound interest | Start “when I have more money” | $100/month at 25 beats $500/month at 35 |

Your Next Step in 2026

Pick one tip from this list and do it this week. Open a high-yield savings account and set up the first automatic transfer. Calculate your real emergency fund target. Increase your 401(k) by 1%.

The difference between the financially stressed and the financially free isn’t income—it’s consistent, boring, ignored actions.

What’s the one tip you’re committing to today? Drop it in the comments—I read every one. And if this helped, share it with someone who’s still living paycheck to paycheck in 2026. They’ll thank you later.

Also Read: How to Save Money in 2026: Smart Personal Finance Strategies